-

Sponsored

Facets of wellbeing: Why they matter to your mental health

Unlock the potential of your subconscious and elevate your mental wellbeing through the transformative power of storytelling with Lotic.ai.

READ STORY

Mishaal Ashemimry is taking social media to the stars

The first woman of Saudi origin to work with NASA, tenacious aerospace engineer Mishaal Ashemimry is taking the equality battle to social media and beyond.

READ STORY

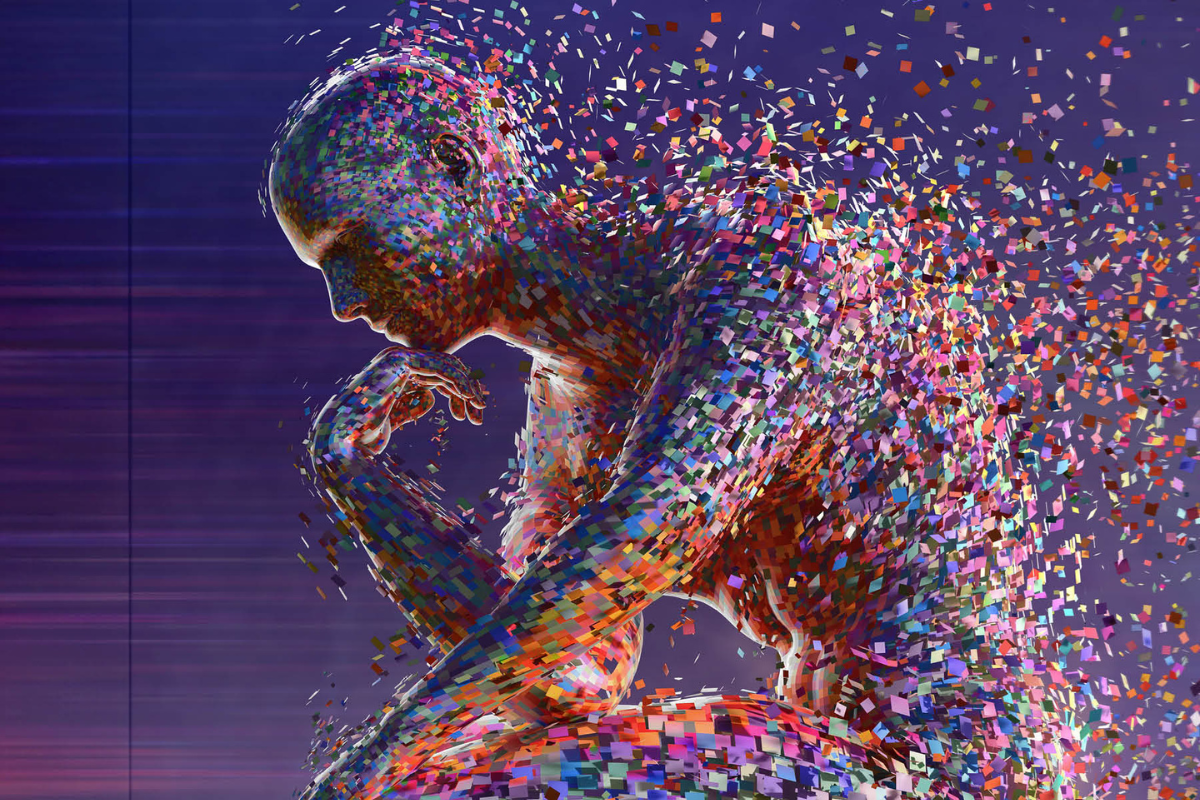

How generative AI is reshaping brand marketing

From AI influencers to digital fashion, generative AI is reshaping not only how organizations function but also the way the world will look in our collective future.

READ STORY

How Wella’s CEO orchestrates success in the beauty sector

Having learned from the best of the best, Annie Young-Scrivner reflects on what’s needed to bring out the best in your teams as a global consumer-centric brand.

READ STORY