-

Sponsored

How Disaster Relief Australia is transforming volunteering

Military veteran Geoff Evans leads an organization that provides disaster relief services to Australians in need, and gives other veterans a purpose in the process.

READ STORY

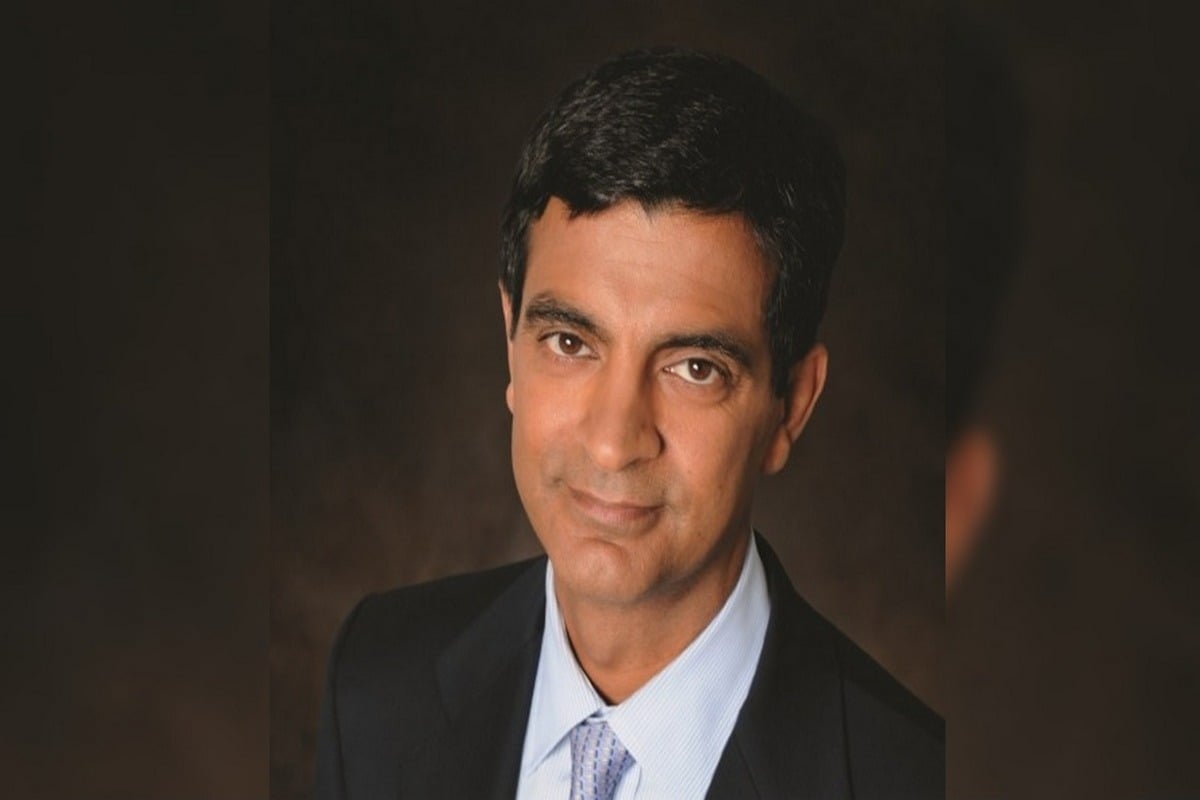

Raymond Watt’s route to strong and effective leadership

Finding your people and being open and honest will help you become a better CEO and person, says YPO Global Chairman and entrepreneur Raymond Watt.

READ STORY

Paris Olympics: who are the real winners and losers?

Billions of dollars will change hands and billions of fans will tune in, but who will actually make a profit out of the greatest sporting show on Earth? With just weeks to go until the famous torch is lit, here’s how it’s shaping up.

READ STORY

Billie Jean King & Ilana Kloss: Courting success

Billie Jean King and Ilana Kloss were champions on the tennis court, but it’s what this powerhouse couple have done off it that has fostered real change for women in business.

READ STORY